year end tax planning checklist 2021

R beginning 2021 ending 20 This return is due on April 18 2022 for calendar year returns or for fiscal year returns it is due on or before the fifteenth day of the fourth month after close of the taxable year. Make sure you never miss another filing date and help your firm run smoothly.

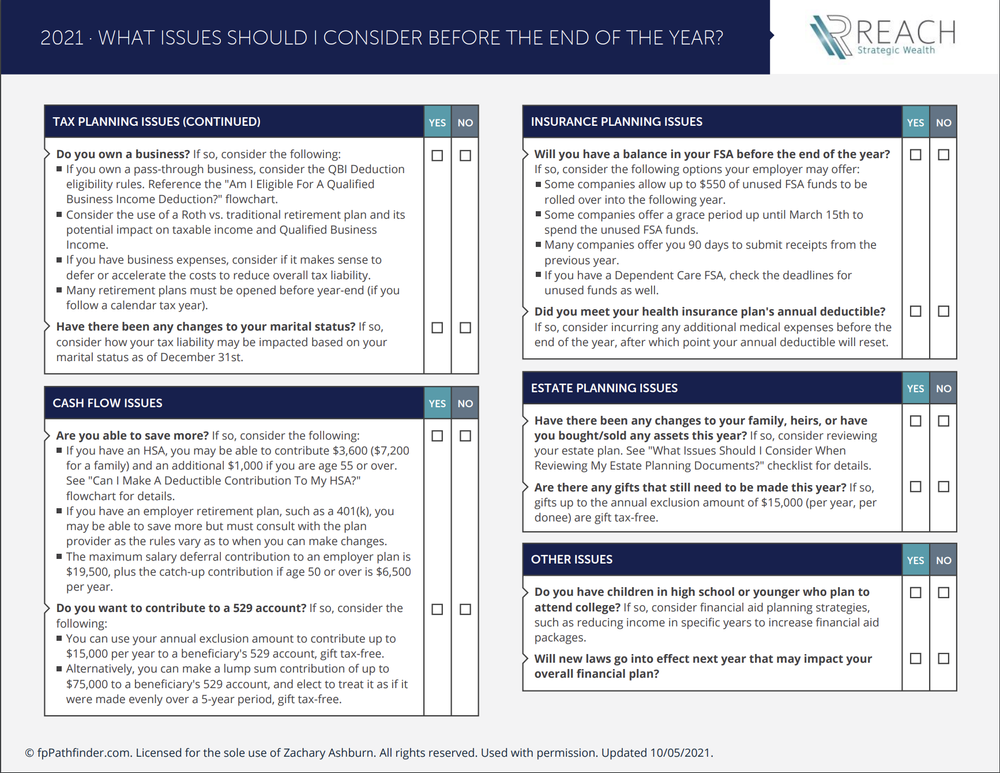

Year End Financial Planning Checklist Reach Strategic Wealth

To help you get started weve compiled together a list of key planning topics to consider.

. The annual gift tax exclusion for gifts to individuals is 15000 per person in 2021. The Low and Middle Income. 2021 Year-End Planning Checklist As 2021 draws to a close now is the time to ensure your wealth plan reflects any changes in your circumstances or goals the economic landscape and the current tax environment.

Review the checklist below and consider which strategies apply to your. Excel close management checklist built by accountants for accountants. Ad Deductions Checklist More Fillable Forms Register and Subscribe Now.

But while this tax credit may be a boon to household budgets now its not free money. Individuals who are 50 or older by the end of the calendar year can make additional catch-up contributions of. In some cases the tax.

Below are some tips to potentially lower your tax bill this year. End Of Year Tax Planning. Effective wealth planning takes place throughout the year.

Get honest pricing with Gusto. As 2021 draws to a close its time to begin organizing your finances for the new year. The standard deduction for the tax year 2021 was.

Close your books faster Crush the next deadline. Ad Easily and efficiently track and manage all your tax filings and projects in your office. You can deduct up to 300 per person meaning you and your spouse can deduct up to 600 if filing jointly.

Get MO MO-1041 2021-2022 Get formShow details. Use e-Signature Secure Your Files. It now allows single filers to deduct up to 300 and married filers up to 600 for cash contributions made directly to a 501c 3.

This was changed to a below-the-line 5 deduction in 2021. Income Tax Planning Consider grouping deductions. Ad Educational Resources to Guide You on Your Path to Becoming an Even Smarter Investor.

No more surprise fees from other payroll providers. American Rescue Plan Act of 2021 effective 3112021 Under the new tax law in 2021 the child tax credit was increased in 2021 temporarily to 3000 per qualifying child or 3600. Proposed legislation presents drastic changes to the tax law that may.

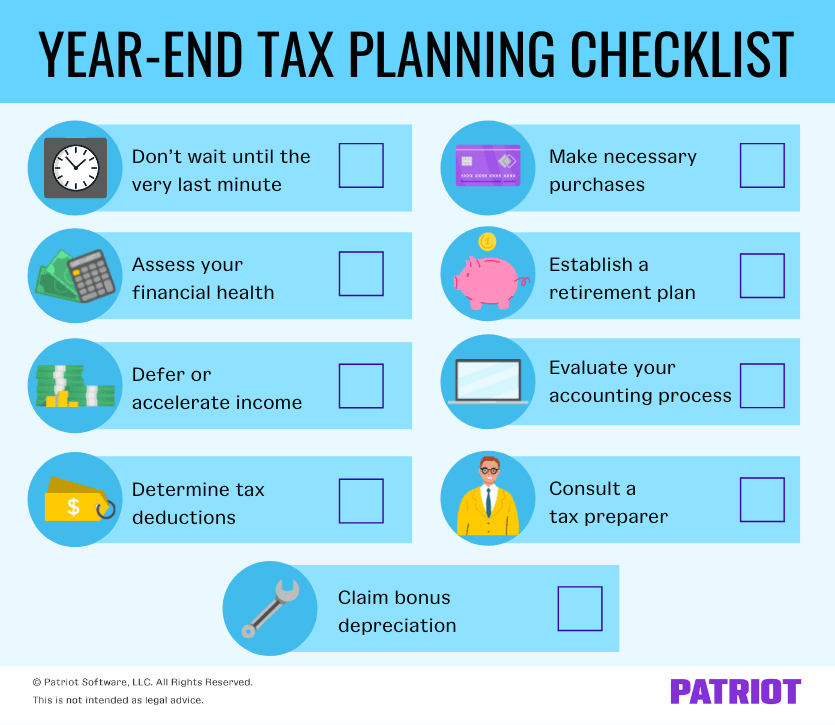

Try it for Free Now. There may be several months left until the end of the year but it is never too early to think about end-of-year tax planning. Year End Tax Planning Checklist 2021 Published On November 4 2021 Written by Robert McCullock SHARE POST SHARE POST ABOUT HOSTS Robert McCullock ABOUT Robert Tax planning is most important before the year-end while you have the ability to control into.

Ad Template for controllers CFOs. 2021 Year-End Tax Checklist. Excel close management checklist built by accountants for accountants.

Contribute to Your 401k or HSA If you have a traditional 401k you can make tax-deductible contributions of 19500 for. Our proactive tax planning finds more tax-deductible items creates tax-advantaged situations and teaches you how to reduce taxes for greater savings in future years. Ad Tax-Smart Investing Can Help You Keep More of What You Earn.

Ad Get full-service payroll automatic tax calculations and compliance help with Gusto. Year-end tax planning checklist Schwab Funds Year-end tax planning checklist November 01 2021 Print View Subscribe of 4 Financial planning 1121-133N Not FDIC Insured No Bank Guarantee May Lose Value. In July 2021 many Americans with young children began receiving a portion of the Child Tax Credit each month250 for those age 6 to 17 and 300 per month for those age 5 and under.

Contact a Fidelity Advisor. By RGAdmin Nov 10 2021 Insights. 2022 Year-End Planning Checklist The end of the year is the perfect time to review your financial planning needs with a professional.

However you can take some key steps before the end of the year and early in the new year from a tax planning. 2021 Year-End Tax Planning Checklist Now is an ideal time to consider year-end tax planning strategies to potentially reduce your taxes and help you achieve your long-term financial goals. The maximum tax-deferred contribution to a 401 k retirement plan has once again increased by 500 reaching 19500 for individuals under age 50 in 2020.

Check to see if this change results in your children paying higher taxes. Upload Modify or Create Forms. In addition to contributing enough to capture any company match consider contributing the 19500 maximum for 2021 plus the 6500 catch up amount if youre age 50 or older.

In 2021 individuals can contribute up to 19500 to a 401k plan and individuals age 50 and. Feb 1 2018 of time to file. With only a few weeks left of the year I talk about a 7 step year-end tax planning checklist.

Close your books faster Crush the next deadline. 2021 year-end tax planning checklist Consider these time-sensitive items plan ahead for 2022. End Of Year Tax Planning Checklists The personal income tax scale stage 2 tax cuts under measures set forth in 2018 were brought forward and take effect from 1 July 2020 for the 2020-21 and following years.

This checklist can help you review your investment portfolio assess year-end tax planning opportunities review retirement goals and manage your wealth. Ad Template for controllers CFOs. Whether you are still waiting to do charitable giving review tax withholdings and estimated tax payments tax-gain harvesting Roth conversions or how best to give to family Ill.

2021 Year-End Tax Planning Checklist 111521 Tax Services for High-Income Individuals Business Tax Year-End Tax Planning Dive into Withums Tax Planning Guide for your one-stop shop for annual year-end individual and business tax planning tips including top. For tax year 2021 the deal is even sweeter.

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

Tax Preparation Checklist Tax 2021 Mbafas

Three Critical Year End Tax Planning Moves

The Economy And Your Year End Tax Checklist Covington Capital Management

2021 Year End Tax Planning Checklist Withum

Tax Season 2021 Checklist For Tax Professionals

Pdf Simple Tax Preparation Checklist Tax Prep Checklist Tax Prep Tax Preparation

The Tax Preparation Checklist Your Accountant Wants You To Use Tax Prep Checklist Tax Prep Tax Preparation

2021 Year End Financial Planning Checklist

Checklist Prepare Your Small Business For 2022 With This Year End Checklist Guidant

Use This Financial Checklist To Get Ahead On Year End Tax Planning

Year End Tax Planning For Small Business Owners

Year End Tax Planning Checklist 2021 Pure Financial Advisors

Tax Prep Checklist Savvymomlife Com

Your End Of Year Financial Planning Checklist With Possible Future Tax Changes In 2021 Planning To Wealth

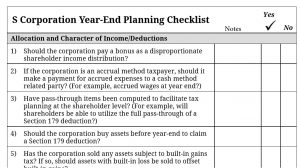

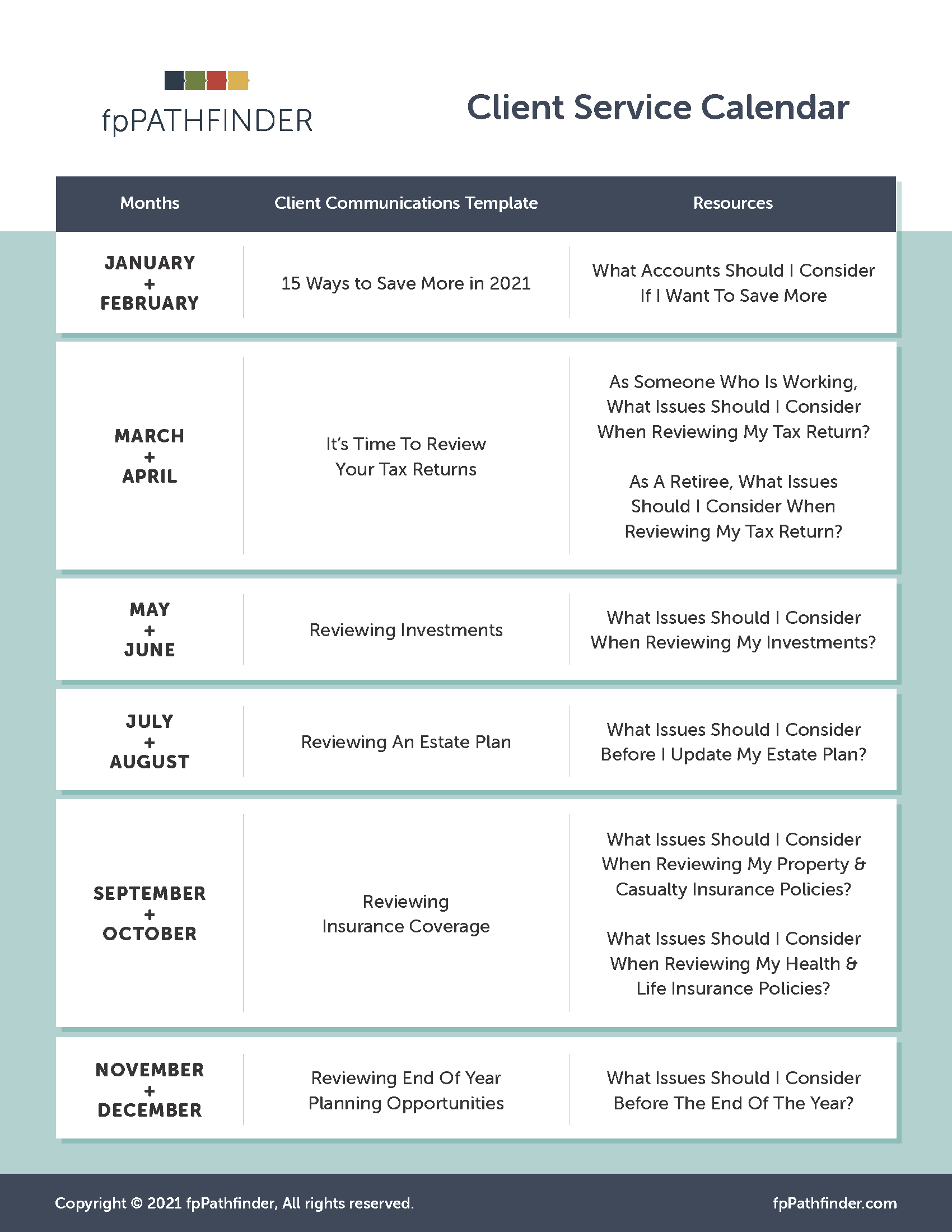

Use Checklists And Flowcharts To Enhance Your Planning Process A Seven Part Series Fppathfinder

2021 Executive Tax Planning And Savings Opportunities